Key Highlights

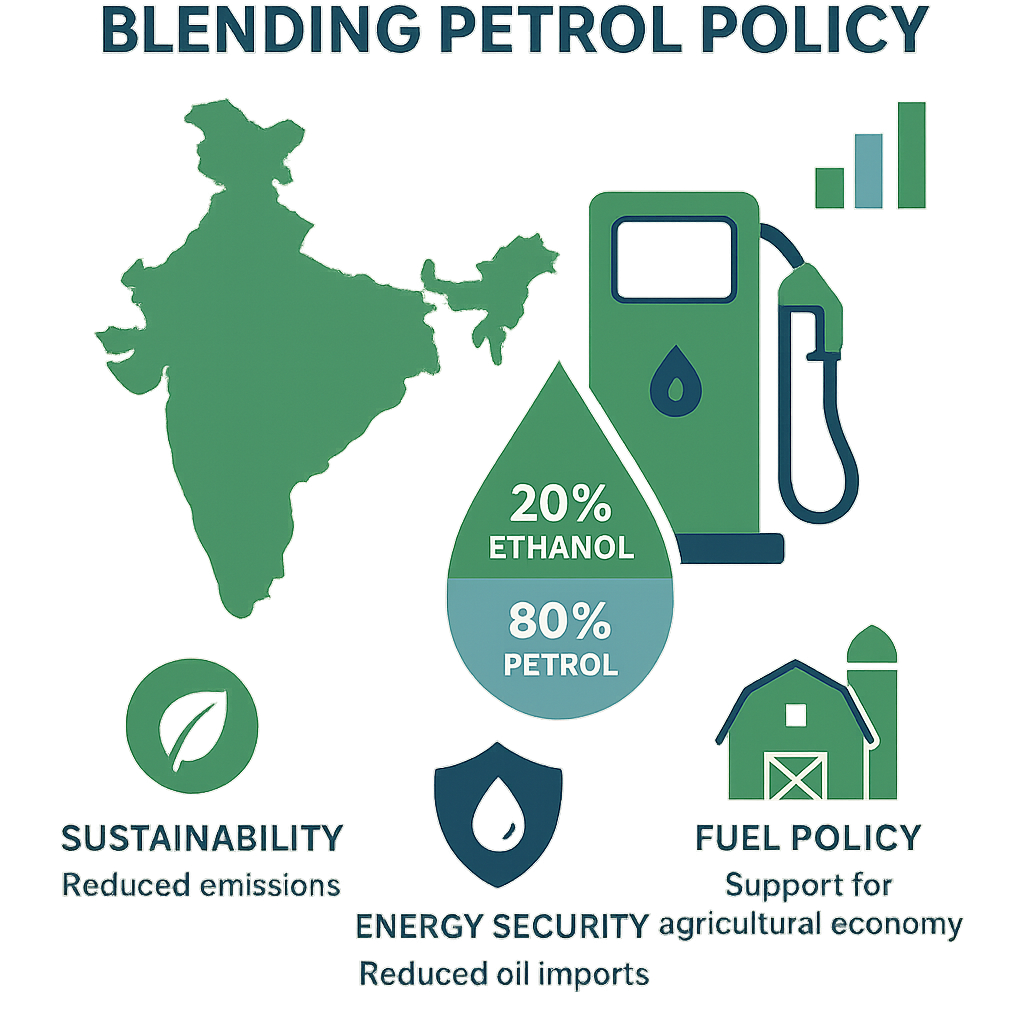

- India achieved E20 target five years early with 20% ethanol blending by March 2025, saving ₹1.40 lakh crore in crude imports

- Grain-based ethanol overtook sugarcane for first time at 52.7%, raising food security concerns as India imported 1 million tonnes corn in 2024

- Water stress intensifies with sugarcane ethanol requiring 2,000-3,000 litres water per litre, threatening groundwater in drought-prone regions

- Infrastructure remains inadequate with only 13,569 out of 81,529 fuel stations offering E20, limiting nationwide accessibility

- Second-generation ethanol offers sustainable alternative with 85-108% emission reductions and no food competition, but faces high costs and technical challenges

India’s ambitious E20 ethanol blending policy has achieved a remarkable milestone, reaching the 20% ethanol blending target by March 2025 – five years ahead of the original 2030 timeline. This accelerated success story represents a thirteenfold increase from the mere 1.53% blending rate in 2014, positioning India as a global leader in biofuel adoption. However, beneath this triumph lies a complex web of food security concerns, environmental trade-offs, and infrastructure challenges that demand critical examination of whether E20 represents a sustainable energy future or a misguided policy experiment. pib downtoearth

The E20 Achievement: Numbers Behind the Success

Production Scale and Infrastructure Development

India’s ethanol production has undergone a dramatic transformation, with corn-based ethanol production surging from 1 million tonnes in 2022 to 11 million tonnes by 2025. The country produced 66 billion litres of ethanol in 2024-25, with 25.5 billion litres from grains (including maize) and the remainder from sugarcane-based feedstock. bioenergytimes

Infrastructure Readiness:

- 13,569 PSU outlets offering E20 petrol out of 81,529 total stations as of April 2024 iamrenew

- 400 dedicated E100 pumps operational for pure ethanol vehicles

- Auto industry compliance achieved with companies like Honda maintaining E20 compatibility since 2009 khaitanbioenergy

The government has approved USD 1.68 billion in loans for 185 ethanol plants, with 36-38 new facilities expected soon to meet the growing demand.

Economic Benefits and Foreign Exchange Savings

The E20 program has generated substantial macroeconomic benefits for India:

Financial Impact:

- ₹1.40 lakh crore saved in crude import costs between 2014-2024

- $4 billion annually projected savings in import bills

- 54.4 million tonnes of CO2 emissions prevented through the program

- Enhanced energy security by reducing dependence on crude oil imports

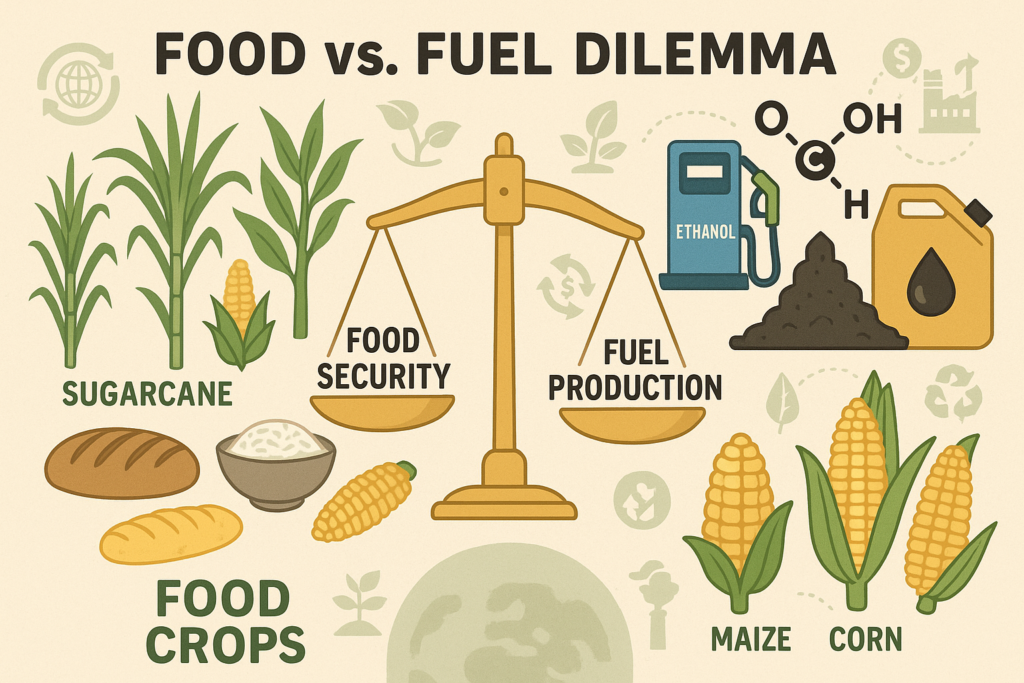

The Food vs. Fuel Controversy: A Critical Analysis

The Shifting Feedstock Landscape

The most contentious aspect of India’s E20 policy is the dramatic shift from sugarcane to grain-based ethanol production:

2024 Feedstock Distribution:

- Grain-based ethanol: 52.7% (211 crore litres) from maize and damaged grains

- Sugarcane-based: 47.3% (190 crore litres) from molasses and juice

- This marks the first time grain contribution exceeded 50%, up from 5% in 2018-19

Concerning Trends:

- 34% of maize diverted to ethanol in 2024, forcing 1 million tonnes of corn imports

- Rice prices increased by 14.51% in 2023 due to ethanol demand pressures

- 187 hectares of maize needed to match energy output of 1 hectare solar energy

Water Stress and Environmental Implications

Water Consumption Crisis:

- Sugarcane ethanol production requires 2,000-3,000 litres of water per litre of ethanol

- Grain-based ethanol plants use 8-12 litres water per litre in processing

- Total water footprint for ethanol production reaches 3,000 litres per litre including cultivation

- Maharashtra and Uttar Pradesh face intensified groundwater depletion risks

Land Use Pressures:

- 7.1 million hectares required for E20 feedstock (approximately 3% of gross cropped area)

- Corn plantation area increased to 9.8 million hectares in summer 2025, marking 17% growth

- Monoculture expansion risks biodiversity loss and soil degradation

Global Comparisons: Learning from International Experience

Brazil: The Success Story

Brazil represents the most successful biofuel implementation globally, with over 30 years of experience:

Brazilian Model Advantages:

- 27% mandatory ethanol blend (E27) in gasoline with no vehicle performance issues

- 85% flex-fuel vehicles capable of running on any ethanol-gasoline proportion

- 7,500 litres ethanol per hectare productivity from sugarcane vs. 3,000 litres from German maize

- 18% of road transport fuel consumption met by ethanol in 2006 ieabioenergy

Policy Framework:

- Guaranteed government purchases at reasonable prices (now discontinued)

- Tax incentives for neat ethanol vehicles during 1980s

- Research centers established for improving sugarcane and ethanol yields

- No pure gasoline vehicles since 1977

USA: The Cautionary Tale

American Experience Highlights:

- Corn-based ethanol dominance criticized for food price increases

- Renewable Fuel Standard mandates drive production

- Energy balance concerns due to fertilizer and processing requirements

- Land use change emissions reduce overall environmental benefits sciencedirect

European Union: Restrictive Approach

The EU has adopted a more cautious stance on first-generation biofuels:

EU Policy Framework:

- Restrictions on first-generation biofuels due to land-use change and food diversion concerns

- Focus on greenhouse gas reduction targets rather than volumetric mandates

- E10 adoption in nine countries with consideration of E20 for climate benefits

- Advanced biofuels sub-target to encourage second-generation technologies

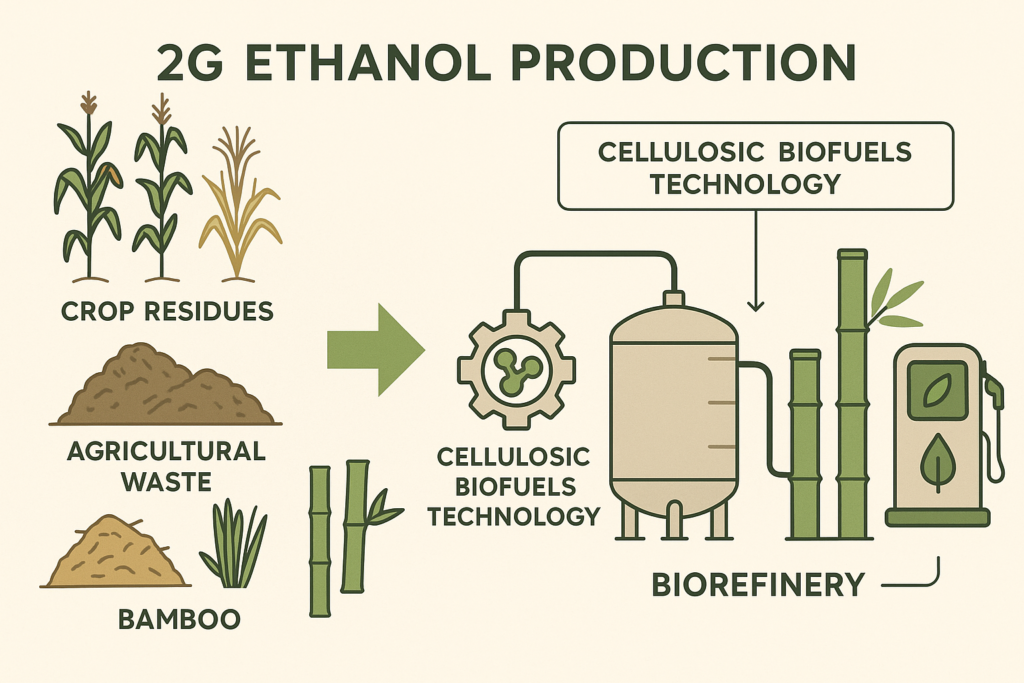

Second-Generation Ethanol: The Sustainable Alternative

Technology and Potential

Second-generation (2G) ethanol offers significant advantages over first-generation feedstocks:

Environmental Benefits:

- 85-108% GHG emission reduction compared to gasoline

- No competition with food crops using agricultural residues

- Higher energy yield per acre compared to first-generation biofuels

- Addresses stubble burning by converting crop residues to fuel pmc.ncbi.nlm.nih

India’s 2G Initiatives:

- Bathinda Bio-refinery (Punjab): 100 KL per day capacity from agricultural residues

- 12 planned 2G bio-refineries across 11 states by Oil PSUs

- Panipat and Numaligarh refineries converting agricultural residues and bamboo

Current Challenges and Limitations

Technical Hurdles:

- High capital costs for cellulosic ethanol plants

- Complex pretreatment processes required for lignocellulosic biomass

- Limited commercial viability without substantial subsidies

- Supply chain development needed for agricultural residue collection leaf-lesaffre

Infrastructure and Consumer Challenges

Vehicle Compatibility Concerns

Compatibility Issues:

- 5-7% fuel efficiency reduction in E20 for E10-calibrated vehicles

- Older vehicles (pre-2023) may experience corrosion and component wear

- Cold-start issues in winter conditions affecting consumer acceptance

- Warranty concerns for non-compliant vehicles

Industry Response:

- All vehicles post-April 2023 engineered for E20 compatibility

- Major manufacturers like Maruti Suzuki and Toyota developing flex-fuel vehicle prototypes

- Society of Indian Automobile Manufacturers confirms no safety hazards from E20

Distribution and Logistics

Infrastructure Gaps:

- Only 13,569 out of 81,529 stations offering E20 as of April 2024

- Limited ethanol pipeline network requiring costly truck/rail transport

- Corrosive nature demands upgraded pumps, tanks, and safety measures

- Rural area coverage remains inadequate for nationwide rollout

Environmental Trade-offs: The Complex Reality

Emission Benefits vs. Environmental Costs

Positive Environmental Impacts:

- 50% reduction in carbon monoxide and 20% reduction in hydrocarbons

- Prevention of 54.4 million tonnes CO2 emissions through the program

- Air quality improvement in urban areas through cleaner fuel combustion

Environmental Concerns:

- Distilleries classified as ‘red category’ polluting industries emitting acetaldehyde and formaldehyde

- 10-15 litres wastewater per litre ethanol generation

- Ozone formation risks from evaporative emissions

- Soil degradation from intensive monoculture farming

Policy Recommendations: Balancing Act for Sustainable Future

Diversified Feedstock Strategy

Immediate Actions:

- Accelerate 2G ethanol development through enhanced R&D investments

- Diversify beyond sugarcane and maize to include millets, jowar, and damaged grains

- Implement buffer stock mechanisms to prevent food price volatility

- Seasonal feedstock planning aligned with agricultural cycles

Water and Environmental Management

Sustainable Production Practices:

- Water recycling technologies in ethanol plants

- Drought-resistant feedstock varieties development

- Strict effluent treatment and air pollution control norms

- Soil health monitoring in intensive cultivation areas

Infrastructure Development

Phased Expansion:

- Gradual E20 rollout ensuring consumer choice between blends

- Pipeline infrastructure development for efficient transportation

- Rural distribution networks expansion

- Technology upgrades for existing fuel stations

Technology and Innovation

Research Priorities:

- Indigenous enzyme technologies for 2G ethanol production

- Integrated bio-refineries producing multiple products

- Flex-fuel vehicle development with Indian manufacturers

- Carbon capture technologies for distilleries

The Verdict: Transition Fuel or Long-term Solution?

The E20 policy represents both remarkable achievement and concerning trends that require careful policy recalibration. India’s success in accelerating ethanol blending demonstrates strong policy commitment and industrial capability. However, the shift toward grain-based feedstock raises legitimate concerns about food security, water stress, and environmental sustainability.

Arguments for E20 as Sustainable:

- Significant foreign exchange savings and energy security benefits

- Rural income enhancement through guaranteed ethanol procurement

- Emission reductions contributing to climate commitments

- Foundation for advanced biofuel technologies development

Arguments for Policy Recalibration:

- Food versus fuel competition intensifying with grain diversion

- Water stress acceleration in already vulnerable regions

- Limited long-term sustainability without 2G technology adoption

- Infrastructure gaps limiting equitable access across regions

The path forward requires pragmatic balancing – treating E20 as a transition fuel while aggressively investing in second-generation technologies and alternative renewable energy sources. The policy should protect food security through buffer stock mechanisms, accelerate 2G ethanol development, and maintain infrastructure expansion for consumer choice.

Brazil’s 30-year success story demonstrates that sustainable ethanol programs are possible, but require long-term commitment, technological innovation, and careful resource management. India’s challenge is replicating this success while avoiding the pitfalls experienced by other countries in balancing energy security with food security and environmental sustainability.

The E20 policy is neither a complete scam nor an unqualified success – it represents a complex policy experiment with both significant achievements and legitimate concerns. The key to its long-term sustainability lies in continuous adaptation, technological advancement, and holistic consideration of food, water, and environmental security alongside energy goals.

Mains Questions

- GS-III (Energy & Environment):

“The E20 policy represents both an opportunity and a challenge for India’s sustainable energy future.” Critically analyze. - GS-II (Governance & Policy):

Discuss how India’s ethanol blending program balances the objectives of energy security, food security, and environmental sustainability.

+ There are no comments

Add yours