Key Highlights

- Economic Powerhouse Status: MSMEs contribute 30.1% to India’s GDP (2022-23), 45.79% to exports (May 2024), and provide employment to over 110 million people, making them the second-largest employment source after agriculture

- Massive Digital Transformation: 5.93 crore businesses registered on Udyam portal as of February 2025, with 99% being micro-enterprises, demonstrating unprecedented formalization and digital adoption in the sector

- Critical Credit Gap Challenge: Despite contributing ₹12.39 lakh crore to exports (2024-25), MSMEs face a ₹25 lakh crore credit gap with only 14% having formal credit access compared to 37% in China and 50% in USA

- Export Growth Trajectory: MSME exports tripled from ₹3.95 lakh crore (2020-21) to ₹12.39 lakh crore (2024-25) with exporting MSMEs increasing from 52,849 to 1,73,350, showcasing remarkable global market penetration

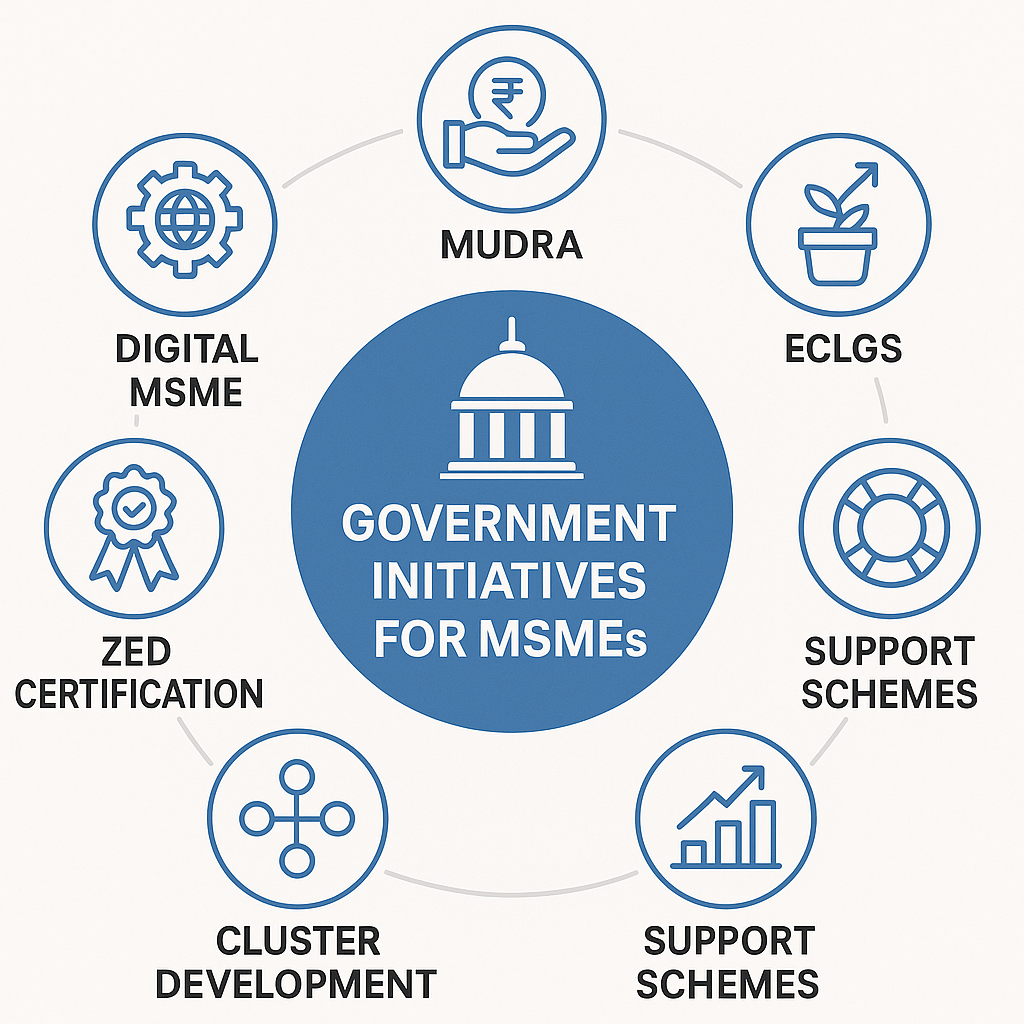

- Government Support Ecosystem: Comprehensive schemes including MUDRA (₹5.41 lakh crore sanctioned FY24), CGTMSE guarantees, RAMP Programme, and Digital MSME initiatives supporting technology adoption and competitive enhancement

The MSME Phenomenon: India’s Economic Backbone

Micro, Small, and Medium Enterprises (MSMEs) represent the most dynamic segment of India’s economy, functioning as the critical bridge between traditional sectors and modern industrial growth. With over 6.3 crore estimated units spread across manufacturing, services, handicrafts, and rural industries, MSMEs form the foundational layer of India’s entrepreneurial ecosystem.

The sector’s resilience became particularly evident during COVID-19, when MSME’s GDP contribution sustained at 27.3% (2020-21) before rebounding strongly to 29.6% (2021-22) and 30.1% (2022-23). This remarkable recovery demonstrates the inherent adaptability and strategic importance of MSMEs in maintaining economic stability during unprecedented global disruptions. pib

Employment generation remains MSMEs’ most significant contribution, providing livelihoods to over 110 million people, particularly in semi-skilled and unskilled categories. The sector’s inclusive nature ensures widespread participation of women, SC/ST communities, and rural populations, making it a powerful tool for equitable development.

Digital Revolution: The Udyam Transformation

Formalization Through Technology

The Udyam Registration Portal represents a watershed moment in MSME formalization, with 5.93 crore businesses registered as of February 2025. This unprecedented scale of digital registration reflects the sector’s transformation from informal operations to structured, verifiable enterprises eligible for government schemes and formal credit. bis

Registration benefits include simplified compliance, access to priority sector lending, government scheme eligibility, and enhanced credibility with financial institutions. The portal’s integration with PAN, GST, and Aadhaar creates a comprehensive digital identity for each enterprise, facilitating easier verification and reducing documentation burdens.

Technology adoption beyond registration includes digital payment systems, e-commerce platforms, and online banking, creating digital footprints that improve credit assessment and market access. UPI transactions and digital payment adoption enable lenders to evaluate business performance through transaction data rather than traditional collateral requirements.

Digital Divide and Inclusion

Despite significant progress, digital adoption remains uneven across enterprise sizes and geographical locations. Urban micro-enterprises demonstrate higher digital payment adoption compared to rural counterparts, creating disparities in access to formal credit and market opportunities.

Government initiatives like Digital MSME and GeM portal integration aim to bridge digital divides while providing platforms for B2B transactions and government procurement opportunities. Fintech partnerships and mobile-first solutions specifically target underserved segments with simplified interfaces and vernacular language support.

The Crore Credit Challenge

Understanding the Credit Gap

India’s MSME credit gap of ₹20-25 lakh crore represents one of the most significant policy challenges limiting sectoral growth and job creation potential. With only 14% of MSMEs having formal credit access, compared to 37% in China and 50% in USA, the financing constraint severely limits expansion and technology adoption. jswone

Credit gap causes include collateral requirements, complex documentation, lack of credit history, and risk perception among traditional lenders. Banks’ preference for large-ticket, long-tenor loans makes MSME lending less attractive due to high underwriting costs relative to loan sizes.

Informal financing with interest rates of 24-36% forces MSMEs into debt traps, limiting reinvestment capacity and growth potential. Priority Sector Lending mandates require banks to allocate 40% of net bank credit to priority sectors, including MSMEs, but implementation gaps persist.

Innovative Financing Solutions

Fintech revolution is transforming MSME lending through alternative credit scoring, digital-first processes, and faster disbursements. NBFCs have emerged as significant players with 18.4% growth in microfinance portfolios (FY2024), offering flexible lending practices and customized products.

Government schemes provide substantial support: MUDRA Yojana sanctioned ₹5.41 lakh crore in FY24, while CGTMSE offers collateral-free loans up to ₹5 crore with 50-85% guarantee coverage. Trade Receivables Discounting System (TReDS) enables MSMEs to discount invoices and improve cash flow.

Digital lending platforms leverage GST data, bank statements, and transaction history for rapid credit assessment, reducing processing time from weeks to hours. API-first integration with Udyam portal enables instant verification and streamlined onboarding. nucleussoftware

Global Value Chain Integration: The Competitive Challenge

Current Participation Gaps

India’s MSME participation in Global Value Chains (GVCs) remains significantly lower than regional competitors, with weak integration limiting export potential and technology transfer opportunities. China’s SMEs contribute 60% of GDP and 70% of employment, demonstrating superior GVC integration compared to India’s 30% contribution. eepcvirtualexpo

GVC participation barriers include limited innovation base, weak inter-firm linkages, inadequate quality standards, and poor access to international markets. Indian MSMEs’ fragmented nature and scale limitations make direct participation in complex global supply chains challenging.

Forward and backward linkages remain underdeveloped, with foreign value-added content in Indian exports being lower than optimal levels for effective GVC participation. Technology gaps and skill deficits further constrain MSMEs’ ability to meet international standards and delivery requirements.

Strategic Integration Pathways

Cluster-based development offers promising solutions for GVC integration by pooling resources, sharing infrastructure, and achieving economies of scale. Successful clusters in textiles, leather, and engineering goods demonstrate how collective action can enhance competitiveness and market access.

Government initiatives including PLI schemes, Quality improvement programs, and Export promotion specifically target MSME participation in global supply chains. Technology transfer programs and R&D support aim to bridge innovation gaps and enhance product quality.

Digital platforms for B2B transactions and export facilitation reduce entry barriers for global market access. Trade facilitation measures and single-window clearances simplify export procedures and reduce transaction costs.

Government Support Ecosystem: Comprehensive Enablement

Credit and Financial Support

MUDRA Yojana’s ₹5.41 lakh crore sanctioned in FY24 demonstrates the scale of government commitment to MSME financing. The scheme’s three categories – Shishu (up to ₹50,000), Kishore (₹50,000-₹5 lakh), and Tarun (₹5-10 lakh) – cater to different enterprise stages and financing needs.

SIDBI’s role as the principal financial institution for MSMEs includes direct lending, refinancing, and capacity building. ECLGS (Emergency Credit Line Guarantee Scheme) provided crucial support during COVID-19, with guaranteed loans helping MSMEs maintain operations and retain employment.

Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) has revolutionized collateral-free lending with guarantee coverage ranging from 50% to 85% depending on loan amount and borrower profile. This risk-sharing mechanism encourages banks to lend to MSMEs without traditional collateral requirements.

Technology and Innovation Support

Digital MSME initiatives focus on technology adoption, digital marketing, and e-commerce integration. Common Facility Centers provide shared infrastructure for testing, certification, and product development, reducing individual investment requirements.

Zero Defect Zero Effect (ZED) certification promotes quality improvement and environmental compliance. ZED-certified MSMEs gain market recognition, export opportunities, and access to premium market segments. Government incentives include subsidy support for certification costs and technology upgradation.

RAMP (Raising and Accelerating MSME Performance) Programme with World Bank support aims to improve access to credit, strengthen institutions, and enhance market access. The program’s focus on technology, sustainability, and formalization addresses key growth constraints.

Market Access and Export Promotion

Government e-Marketplace (GeM) provides direct access to government procurement, with MSMEs receiving preference in public sector purchases. Special provisions for MSME participation in government tenders create assured market opportunities and cash flow stability.

Export promotion schemes include market development assistance, participation in international trade fairs, and export credit at concessional rates. Trade promotion organizations provide market intelligence and buyer-seller matching services.

Cluster development programs create shared infrastructure including common facility centers, testing labs, and effluent treatment plants. Cluster-based approach enables MSMEs to achieve economies of scale and compete effectively in domestic and international markets. pib

Sectoral Performance and Employment Impact

Manufacturing Excellence

MSMEs contribute 45% to manufacturing output, demonstrating their critical role in India’s industrial ecosystem. Traditional sectors like textiles, leather, food processing, and wood products continue to be MSME-dominated, while emerging sectors like electronics and renewable energy show growing MSME participation.

Engineering goods exports by MSMEs have shown consistent growth, benefiting from global supply chain diversification and China+1 strategies. Automotive component manufacturing by MSMEs supports India’s position as a global automotive hub.

Handicrafts and handloom sectors dominated by MSMEs contribute significantly to cultural preservation and rural employment. Government support through scheme like PM Vishwakarma provides skill development and financial assistance to traditional artisans.

Service Sector Growth

Service MSMEs in IT, retail, hospitality, and logistics have shown remarkable growth, particularly in urban areas. Digital platforms enable service MSMEs to reach wider markets and scale operations without significant capital investment.

Women-led enterprises are particularly prominent in service sectors, with over 20% of MSMEs being women-owned according to Udyam registration data. Self-help group linkages and microfinance support enable women entrepreneurs to establish and scale service businesses.

Regional Development and Rural Impact

Rural Industrialization

MSMEs serve as catalysts for rural industrialization, providing non-farm employment opportunities and reducing urban migration pressures. Agro-based industries, food processing units, and handicraft enterprises in rural areas create local value addition and employment generation.

Skill development programs aligned with local resources and market demands enhance rural entrepreneurship. Khadi and Village Industries Commission (KVIC) supports traditional industries while promoting modern technology adoption.

Infrastructure development in rural areas including power, transportation, and telecommunications enables MSME growth and market connectivity. Digital India initiatives bridge digital divides and enable rural MSMEs to access wider markets.

Inclusive Growth Impact

SC/ST entrepreneurs benefit from reservation policies and special schemes designed to promote inclusive entrepreneurship. Venture Capital Fund for Scheduled Castes provides equity financing for SC entrepreneurs in technology sectors.

Minority communities receive targeted support through schemes like Stand Up India and USTTAD (Upgrading the Skills & Training in Traditional Arts/Crafts for Development). These initiatives ensure broad-based participation in entrepreneurial activities.

Challenges and Strategic Solutions

Infrastructure and Technology Gaps

Infrastructure deficits including power supply, transportation, and logistics continue to constrain MSME growth, particularly in Tier-2 and Tier-3 cities. Cold storage facilities for food processing MSMEs remain inadequate, leading to high wastage and reduced profitability.

Technology adoption remains slow due to cost constraints and skill limitations. Digital literacy programs and technology demonstration centers aim to accelerate adoption of modern production techniques and digital tools.

R&D investment by MSMEs is significantly lower than global benchmarks, limiting innovation capacity and product differentiation. Government support for collaborative R&D and incubation centers addresses resource constraints.

Regulatory and Compliance Issues

GST compliance remains challenging for small enterprises due to complex procedures and frequent changes. Simplified return filing and composition schemes aim to reduce compliance burden while maintaining tax collection efficiency.

Environmental regulations require MSMEs to invest in pollution control and sustainable practices. Common Effluent Treatment Plants in clusters provide cost-effective solutions for environmental compliance.

Labor law compliance and social security provisions for MSME workers require simplified procedures and digital platforms to reduce administrative burdens. E-Shram portal registration enables social security benefits for informal workers.

Future Outlook and Strategic Vision

Atmanirbhar Bharat and ₹5 Trillion Economy

MSMEs are fundamental to achieving India’s ₹5 trillion economy target, with projections indicating significant contribution growth through enhanced productivity and global market integration. Import substitution opportunities in sectors like electronics, pharmaceuticals, and defense equipment provide substantial growth potential.

Make in India initiatives specifically target MSME participation in strategic sectors, providing incentives for local manufacturing and technology development. Production Linked Incentive (PLI) schemes include provisions for MSME participation in eligible sectors.

Sustainability focus drives green MSMEs development with environmental compliance becoming market differentiator. Green financing and carbon credit opportunities create new revenue streams for environmentally compliant enterprises.

Technology Integration and Industry 4.0

Digital transformation will accelerate through IoT adoption, AI-powered analytics, and automated production systems. Cybersecurity considerations become critical as MSMEs increase digital adoption, requiring robust security frameworks and awareness programs.

Blockchain technology for supply chain transparency and smart contracts for B2B transactions will enhance efficiency and reduce transaction costs. 3D printing and additive manufacturing enable MSMEs to offer customized products and reduce inventory costs.

Global Integration Strategies

Post-COVID supply chain diversification creates opportunities for Indian MSMEs to integrate into global value chains as companies seek alternatives to China-centric manufacturing. Free Trade Agreements and bilateral partnerships provide preferential market access.

Quality certification and international standards compliance become essential for global market participation. Government support for ISO certification, testing facilities, and quality improvement programs enhances export competitiveness.

E-commerce platforms for international trade enable direct market access without traditional intermediaries. Digital marketing and social media presence become crucial for brand building and customer acquisition in global markets.

Conclusion

MSMEs represent the beating heart of India’s economy, contributing 30.1% to GDP and providing employment to over 110 million people while driving 45.79% of exports with remarkable resilience and adaptability. The digital revolution through the Udyam portal has formalized 5.93 crore enterprises, creating unprecedented opportunities for formal credit access, government scheme participation, and technology adoption.

The ₹25 lakh crore credit gap remains a critical challenge, but innovative fintech solutions, government schemes like MUDRA, and CGTMSE guarantees are steadily expanding formal credit access from the current 14%. MSME exports tripling from ₹3.95 lakh crore to ₹12.39 lakh crore between 2020-21 and 2024-25 demonstrates the sector’s tremendous growth potential and global competitiveness.

Government support ecosystems including comprehensive schemes, technology initiatives, and market access programs provide strong foundational support for MSME growth. Digital transformation, cluster development, and export promotion create synergistic effects that enhance overall sectoral performance.

Global Value Chain integration remains an area requiring focused attention, with lessons from China and Southeast Asian economies highlighting the importance of scale, technology adoption, and inter-firm linkages. Strategic cluster development and collective action can bridge competitiveness gaps and enable effective GVC participation.

Employment generation by MSMEs extends beyond numbers to include inclusive growth, women empowerment, and rural development. The sector’s ability to provide opportunities for marginalized communities and traditional artisans makes it a powerful tool for social transformation and equitable development.

Technology adoption through Digital MSME initiatives, ZED certification, and Industry 4.0 integration will determine future competitiveness. Cybersecurity, sustainability, and innovation become critical differentiators in increasingly competitive markets.

The path forward requires continued focus on bridging credit gaps, enhancing technology adoption, strengthening global integration, and maintaining supportive policy environments. MSMEs’ success is inextricably linked to India’s achievement of its ₹5 trillion economy target and Atmanirbhar Bharat vision.

Challenges including infrastructure deficits, skill gaps, and regulatory complexities require sustained attention and innovative solutions. Public-private partnerships, technology-enabled solutions, and stakeholder coordination will be essential for addressing systemic constraints.

MSMEs have demonstrated remarkable resilience during global disruptions and continue evolving to meet changing market demands. Their contribution to India’s economic stability, employment generation, and export growth positions them as indispensable partners in India’s development journey.

Success in unlocking MSME potential will determine India’s ability to achieve sustainable, inclusive growth while maintaining competitiveness in rapidly evolving global markets. The foundation is strong, and the trajectory is promising for MSMEs to continue powering India’s economic transformation.

📌 Mains Practice Questions

- “MSMEs are the silent drivers of India’s economic resilience but face structural bottlenecks.” Discuss with reference to policy measures.

- Examine the role of MSMEs in inclusive development. How can India ensure their integration into global value chains?

+ There are no comments

Add yours